Funny – but it’s fraud

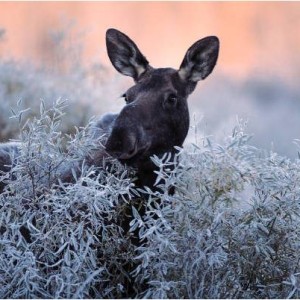

Tales of attempted fraud can be awfully amusing but horribly expensive – like the guy who was collecting insurance benefits for an injury he claimed prevented him from working. The gentleman, however, won a moose hunting lottery permit and his name was published in the newspaper. The insurance company’s fraud unit, having scanned the list, called to congratulate the hunter on his good fortune and offered “guide” services to determine where the “injured” worker would be hunting. The story gets even better from here…

Though the hunter declined the guide services, the fraud unit found the claimant after he had proudly bagged his moose. The investigators walked onto the scene laden down with cameras in awe of the mighty moose and the skill of the happy hunter.

“Say fella, that’s a great trophy. You shoot that bull yourself?”

“Yup! Look at the rack on this baby.”

“Gee, if we don’t get some video of this, the folks back home won’t believe it. Would you mind hoisting up the head so we can show ‘em?”

“Not a problem,” said the “injured” hunter as he easily hoisted the head nice and high to pose with his moose.

“click” – the investigators bagged their fraud perpetrator.

Then there’s the gent who made a claim for the theft of a 21-foot power boat locked in his garage. The investigator asked if the inboard/outboard craft was on a trailer. Yes, indeed, it was 25 feet from the trailer tongue to the stern.

The investigator went to the garage and asked if the building was where the boat was stored. Yes, indeedie!

The investigator pulled out a tape measure and determined that the one-car garage with the door closed was 18 feet deep. It was easy to do the math. The boat was later found at his brother-in-law’s house.

Though these are examples of the finely tuned minds of those who would try to perpetrate fraud, it isn’t really a laughing matter. According to the American Agent & Broker magazine, fraud in the United States costs us all about $80 billion a year and instances of fraud are rising.

People often try to rationalize padding their claims or making up stories about theft, injuries or damage by saying they’ve paid their premiums for years so they deserve something in return. In fact, about 25 percent of people responding to one poll said it was acceptable to commit fraud against an insurance company.

Then there are the subtle ways in which insurance costs are driven higher:

Under-reporting payrolls or misclassifying workers unfairly reduces the cost of workers’ compensation insurance.

Paying “under the table” not only avoids paying workers’ compensation insurance, it deprives everyone of the worker’s contribution to social security, Medicare and taxes.

Billing for work or services not performed by health care providers to contractors and auto repair facilities drives up the price of insurance.

Inflating values or the age of engagement rings, electronic equipment and furnishings also drives higher claim costs.

Worse are those who put others in danger when trying to collect insurance settlements. According to the Coalition Against Insurance Fraud, a Michigan landlord burned down nine fixer-upper properties putting firefighters and neighbors at risk. His trial for insurance fraud concluded this past year with a 55 year sentence in federal prison.

One aspect of fraud common in more urban markets is staged auto accidents where personal injuries are involved. Some states have no-fault provisions that all but guarantees payment unless fraud is discovered. The good news is that insurance companies and industry trade groups talk to each other to identify repeat claimants. The Insurance Services Office maintains a shared claims database so participating insurance companies can detect individual patterns as well as highly organized fraud.

In cases of questionable “accidents”, take the following precautions:

Take photos or a video recording

Get contact and license information of drivers, passengers and witnesses

Inquire as to the well-being of others involved to establish potential injuries

If you believe you have been a victim of fraud or suspect fraud, contact your insurance agent, insurance company or the attorney general’s office. If you think an insurance agent or insurance company has taken unfair advantage of you, contact your state insurance department. Fraud is no laughing matter though you have to smile when people are apprehended and brought to justice.